Rainbow Trend Main Indicator Overvierw

Bearish Candle Colors

- Red - Normal Bearish Candle

- Orange - Strong Bearish Candle

- Yellow - Stronger Bearish Candle - Good Entry

- White - Extreme Bearish Candle - Place Bids ASAP

Bullish Candle Colors

- Green - Normal Bullish Candle

- Blue - Strong Bullish Candle - Good Take Profit/Stop Loss

- Purple - Stronger Bullish Candle - Great Take Profit Point

- Pink - Extreme Bullish Candle - Take Profits ASAP

Example

Rainbow Trend Installation and Tuning

Initial Indicator Setup

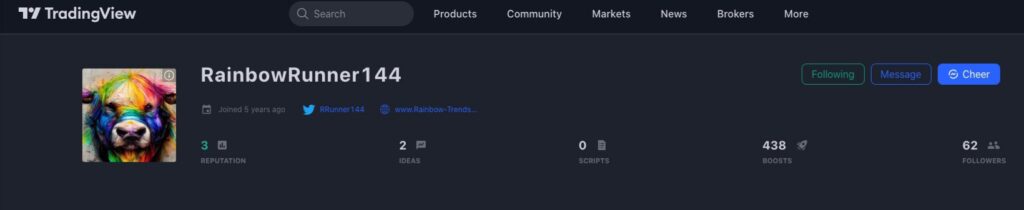

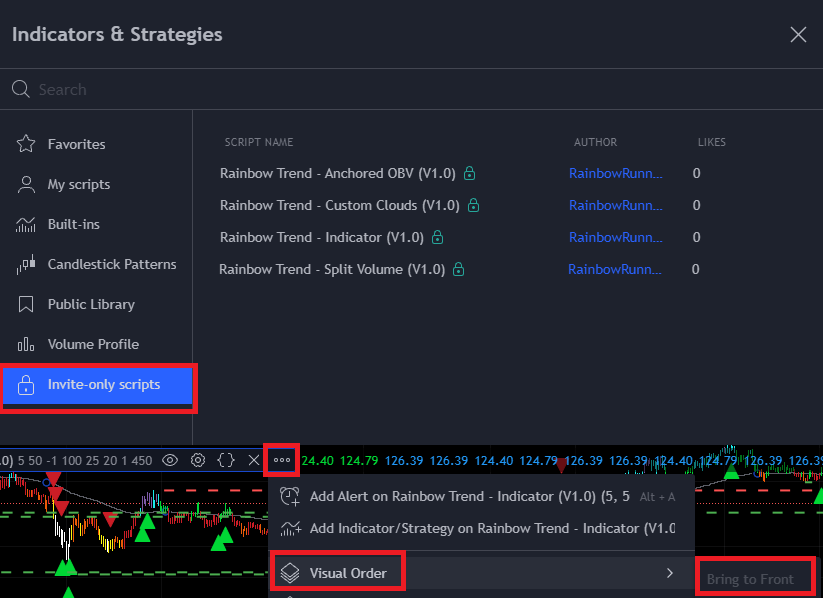

Within 24 hours of your order being completed, the Rainbow Trend Tool Suite will be linked to your Trading View account. These tools will be listed under the Invite Only Section of your Indicators and Strategies tab in Trading View.

** COLORS WILL ONLY DISPLAY PROPERLY AFTER YOU TELL TRADING VIEW TO BRING THE INDICATOR TO THE FRONT. **

This is due to the layering system used for indicators in Trading View. Once the Rainbow Trend has been added to your chart, click the bring forward option to allow the colors to be properly viewed. See graphic below.

Rainbow Color Tuning

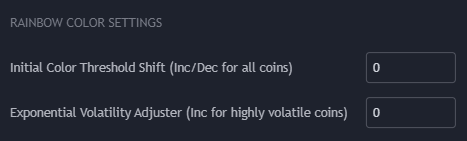

Rainbow Color Settings

Initial Color Threshold Shift – This setting is the main setting used to shift the threshold of when the indicator will change it’s colors in a linear manner.

Exponential Volatility Adjuster – This setting is a secondary tuner used to adjust for highly volatile coins (SHIB, DOGE, SOL, ETC, etc.). This setting will spread the different color thresholds further apart in an exponential manner.

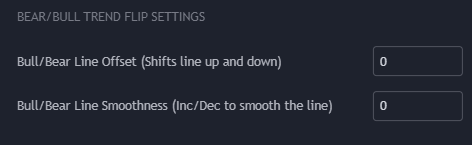

Bear/Bull Trend Flip Settings

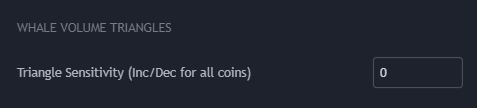

Whale Marker Settings

Whale Markers are significant volume anomalies that are detected by the algorithm that are marked by bullish/bearish triangles. Each stock/coin has different volume flows in and out of the coin that the algorithm scans through. Adjusting the Sensitivity will allow the trader to custom tailor settings for the exact time frame and asset that they are trading.

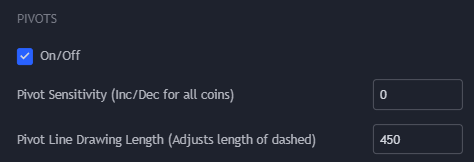

Pivot Settings

Bullish Trend Reversals

Bearish Trend Reversals

Whale Markers

Rainbow Pivots